[Draft]

[SSRN]

[BibTex]

@techreport{kontz2023esg,

title={Do ESG Investors Care About Carbon Emissions? Evidence From Securitized Auto Loans},

author={Kontz, Christian},

type={Working Paper},

institution={Stanford University},

year={2023},

}

Abstract:

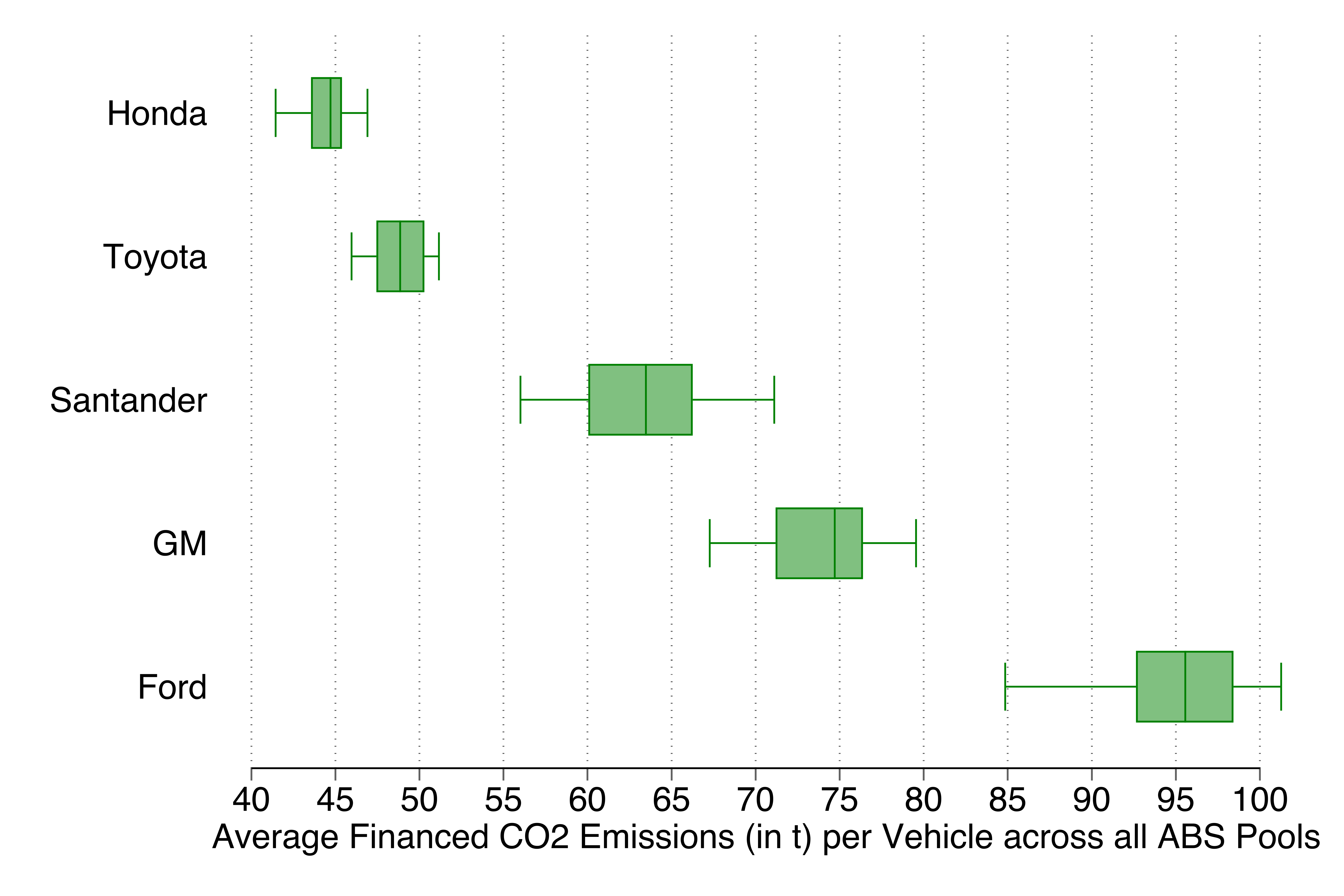

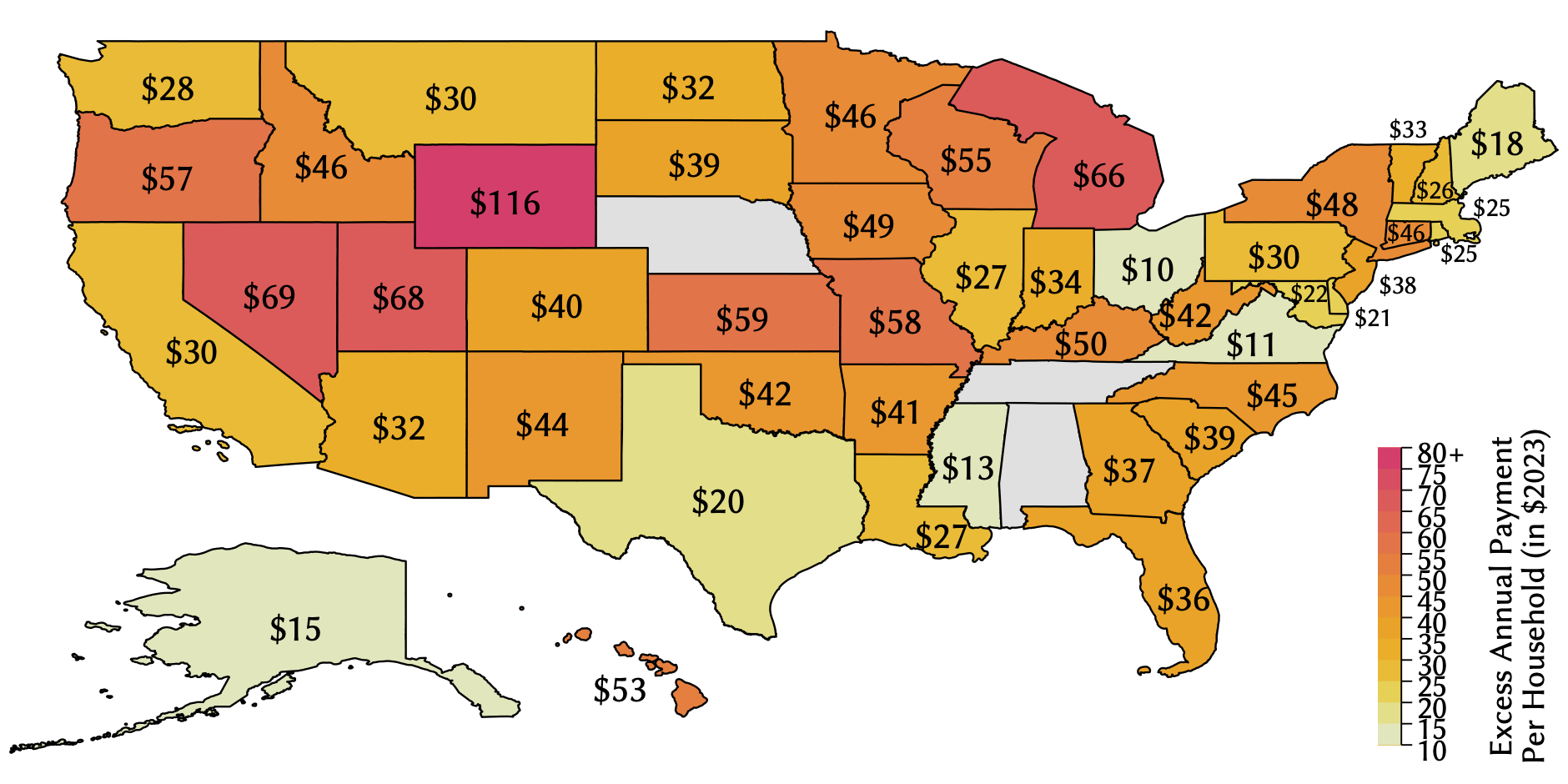

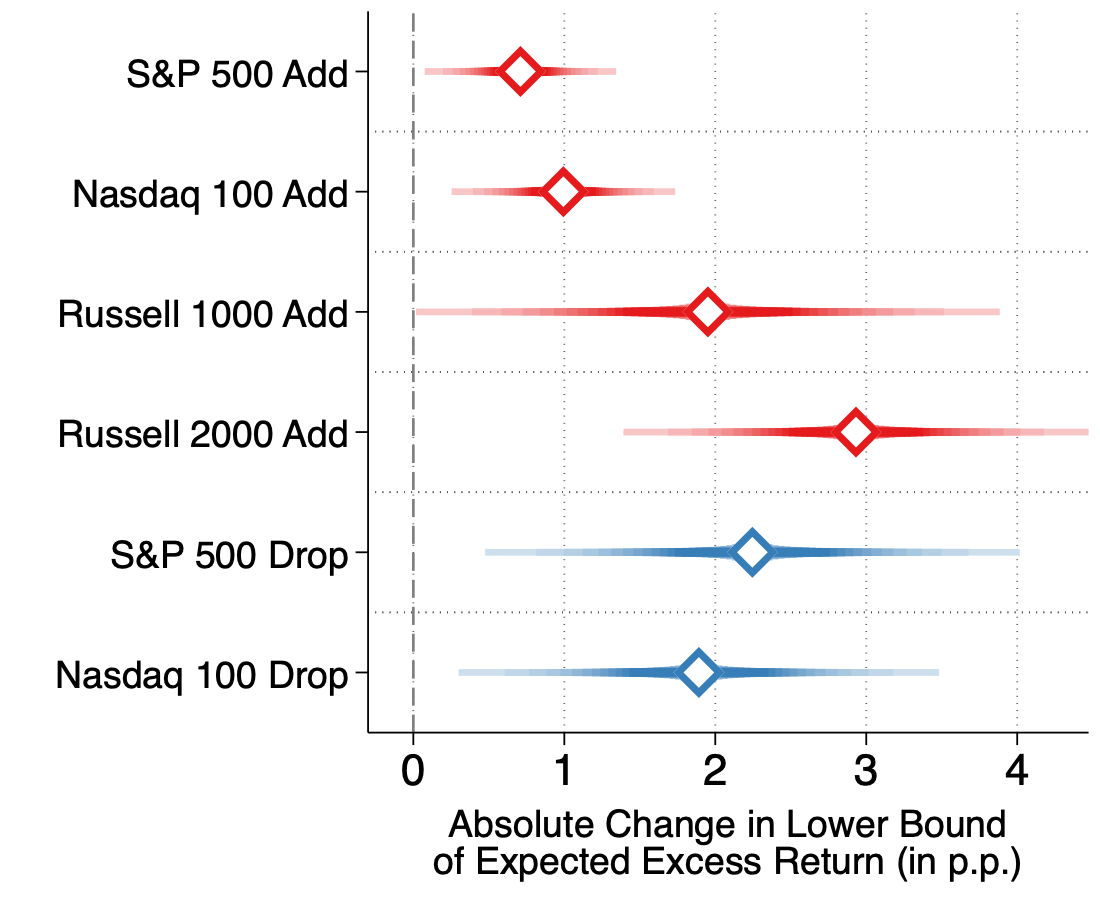

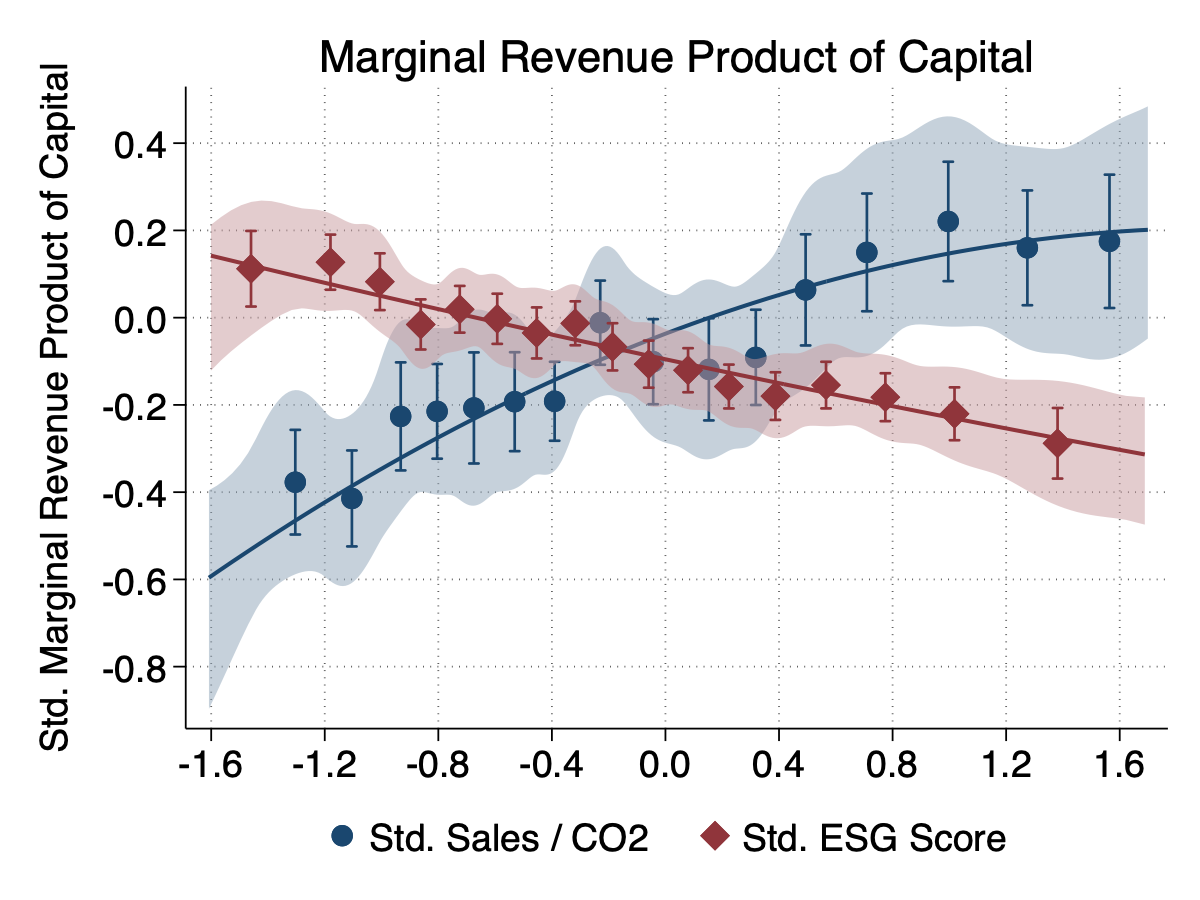

This paper documents that ESG preferences in fixed income markets affect real outcomes through securitization. I find that higher ESG scores lower funding costs for auto loan securitizations and that captive lenders pass through these savings to consumers: an 8 basis point ESG funding advantage translates into a 20 basis point lower consumer interest rate. The high pass-through is driven by a 6 percentage point higher probability of receiving subsidized interest rates (e.g., 0% financing). The lower consumer borrowing costs increase loan demand by up to 4.6%. Yet because issuer ESG scores are weak proxies for financed CO2 emissions, the same mechanism reduces the cost of capital for high-emission vehicles. A subjective-beliefs model can explain how investors who intend to price emissions but implement it via ESG scores lower the cost of capital of high-emission vehicles.

Selected Presentations: FIRS Conference 2024, OU-RFS Climate and Energy Conference 2024, GRASFI Conference 2024, SoFiE Conference 2024, CEPR-ESSEC-Luxembourg Conference on Sustainable Financial Intermediation, Harvard Climate Economics Workshop, UC Santa Cruz

Awards: UN PRI Best PhD Student Paper Award 2025, FIRS Conference 2024 Prize for PhD Students, GRASFI Conference 2024 Best PhD Paper Award, Myron S. Scholes PhD Prize 2024, Finalist FIASI Fixed Income Competition 2024