The Real Cost of Benchmarking

with Sebastian Hanson

Abstract:

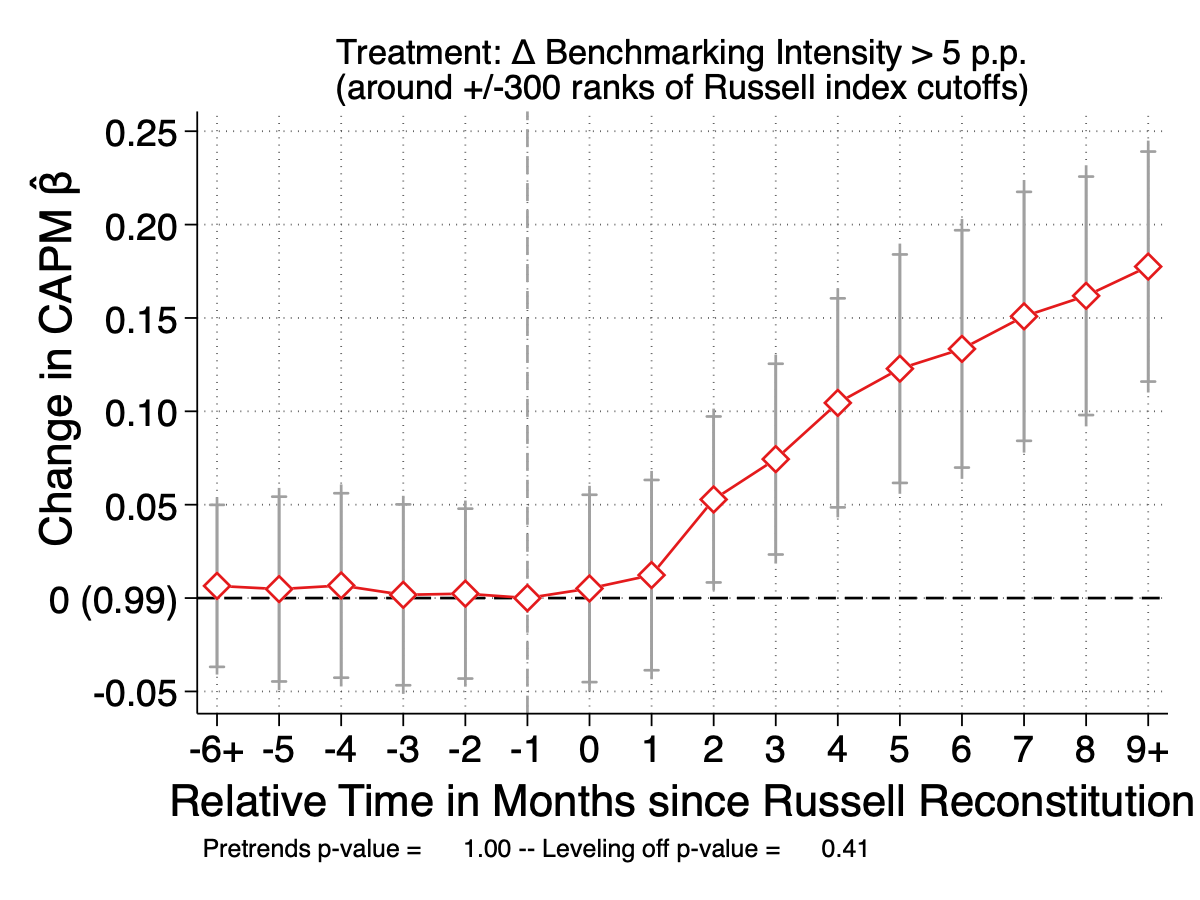

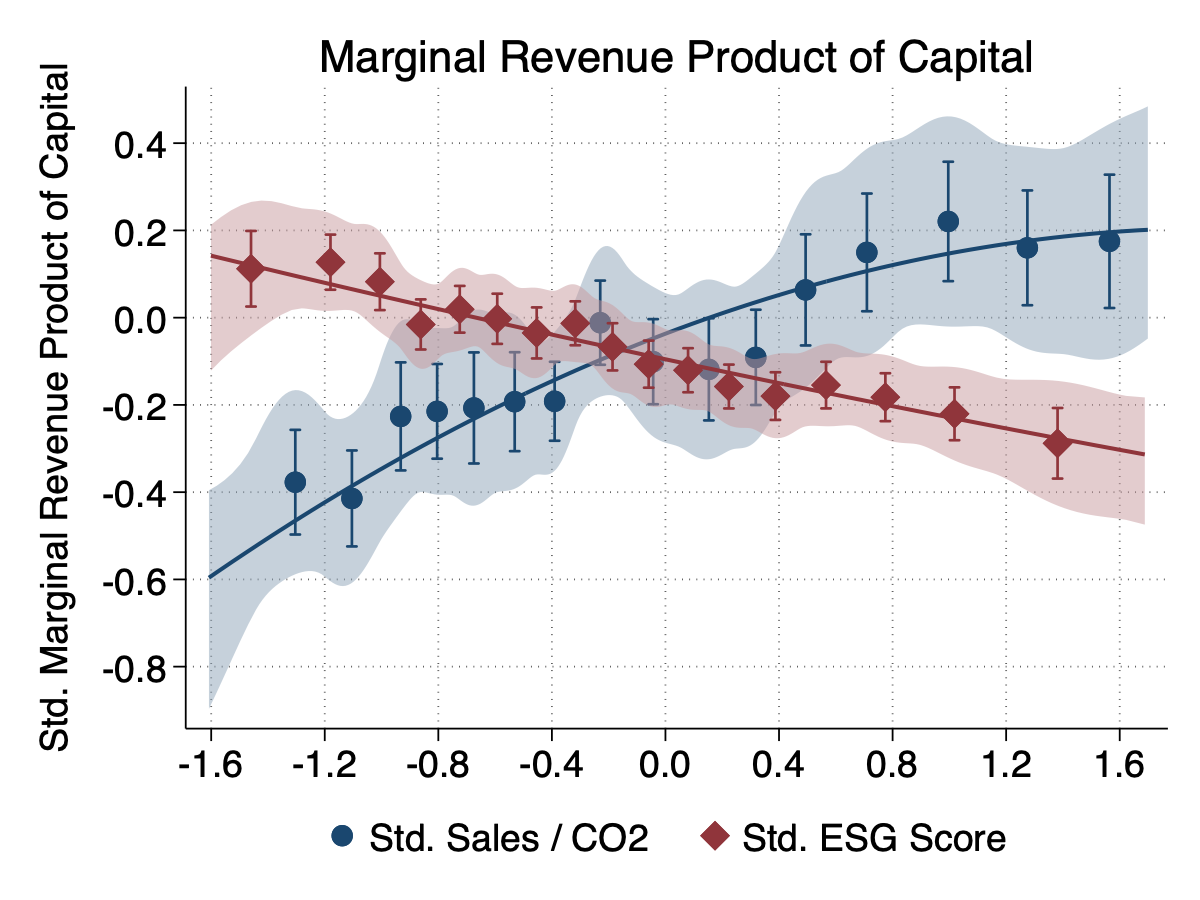

This paper provides causal evidence that asset price distortions caused by benchmarking affect corporate investment decisions. We document that the rise in benchmark-linked investing over the past two decades fundamentally changed the cross-section of CAPM βs. Exploiting exogenous variation from Russell index reconstitutions, we show inclusion in benchmark indices leads to higher CAPM βs, with larger effects observed among stocks facing greater benchmarking intensity. Firm managers interpret the resulting higher CAPM β as an increase in their firm's cost of capital, leading them to reduce investment. Six years after inclusion, firms experience 7.1% and 8.4% declines in physical and intangible capital, respectively. Supporting evidence shows that benchmark-inclusion similarly increases the perceived cost of equity among stock analysts and regulators. We find consistent results at the industry level. Industries which experienced greater increases in CAPM βs due to benchmarking accumulated less capital over the past two decades. Moreover, benchmarking creates excess dispersion in the cost of capital within industries, causing inefficient capital allocation across firms. The rise in CAPM βs largely offset the decline in the risk-free rate over the past decades and can explain 57% of the “missing investment” puzzle.

[Draft]

[SSRN]

[BibTex]

Selected Presentations:

AFA Annual Meeting 2026*,

SFS Cavalcade NA 2025,

FIRS 2025,

Four Corners/FMRC Conference on Indexing,

Investment Company Institute,

Northeastern University Finance Conference 2025,

UIC Finance Conference 2025c,

Citadelc

( * scheduled, c co-author)

( * scheduled, c co-author)

Awards: SFS Cavalcade PhD Student Award, FIRS Conference 2025 Prize for PhD Students