[Draft]

[SSRN]

[BibTex]

@techreport{kontzhanson2024,

title={The Real Cost of Benchmarking},

author={Kontz, Christian and Hanson, Sebastian},

type={Working Paper},

institution={Stanford University},

year={2024},

}

[CAPM β Simulator]

Abstract:

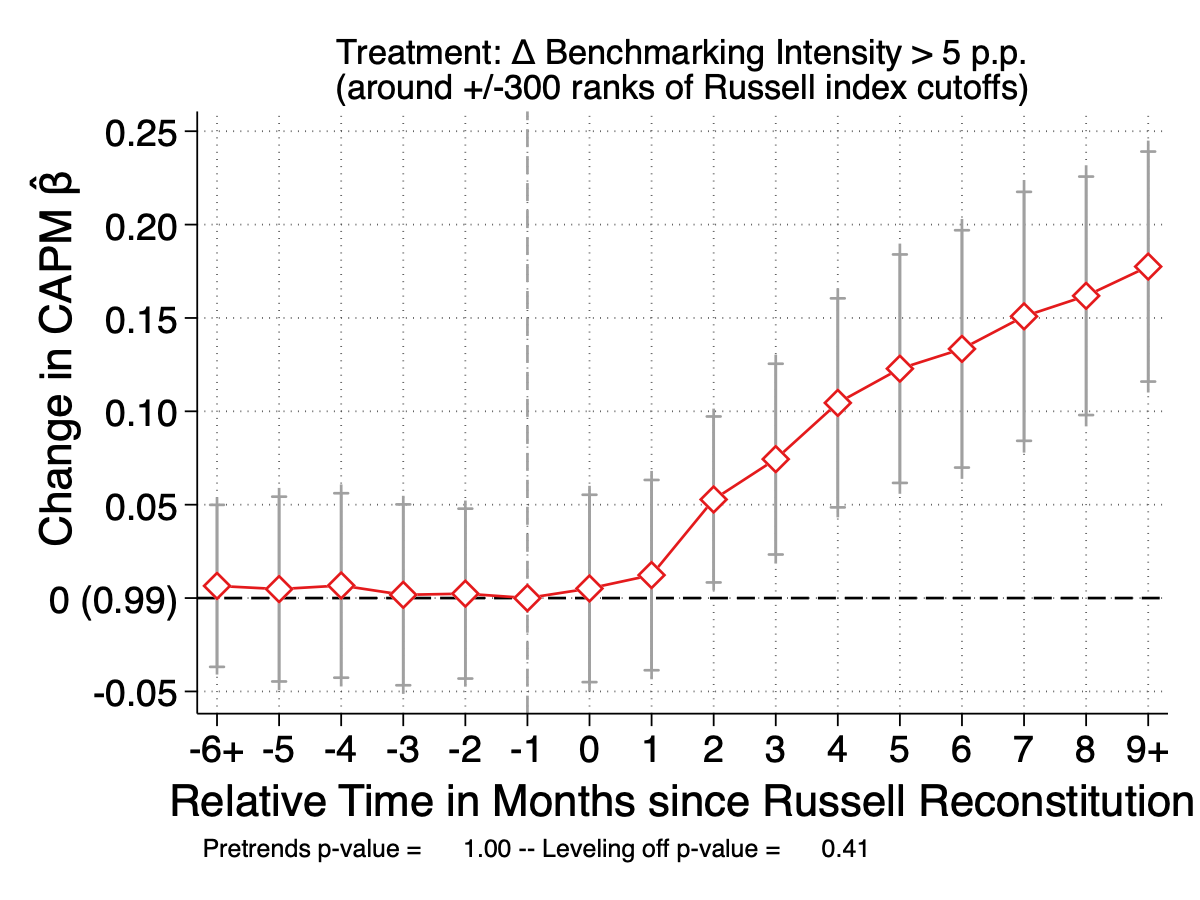

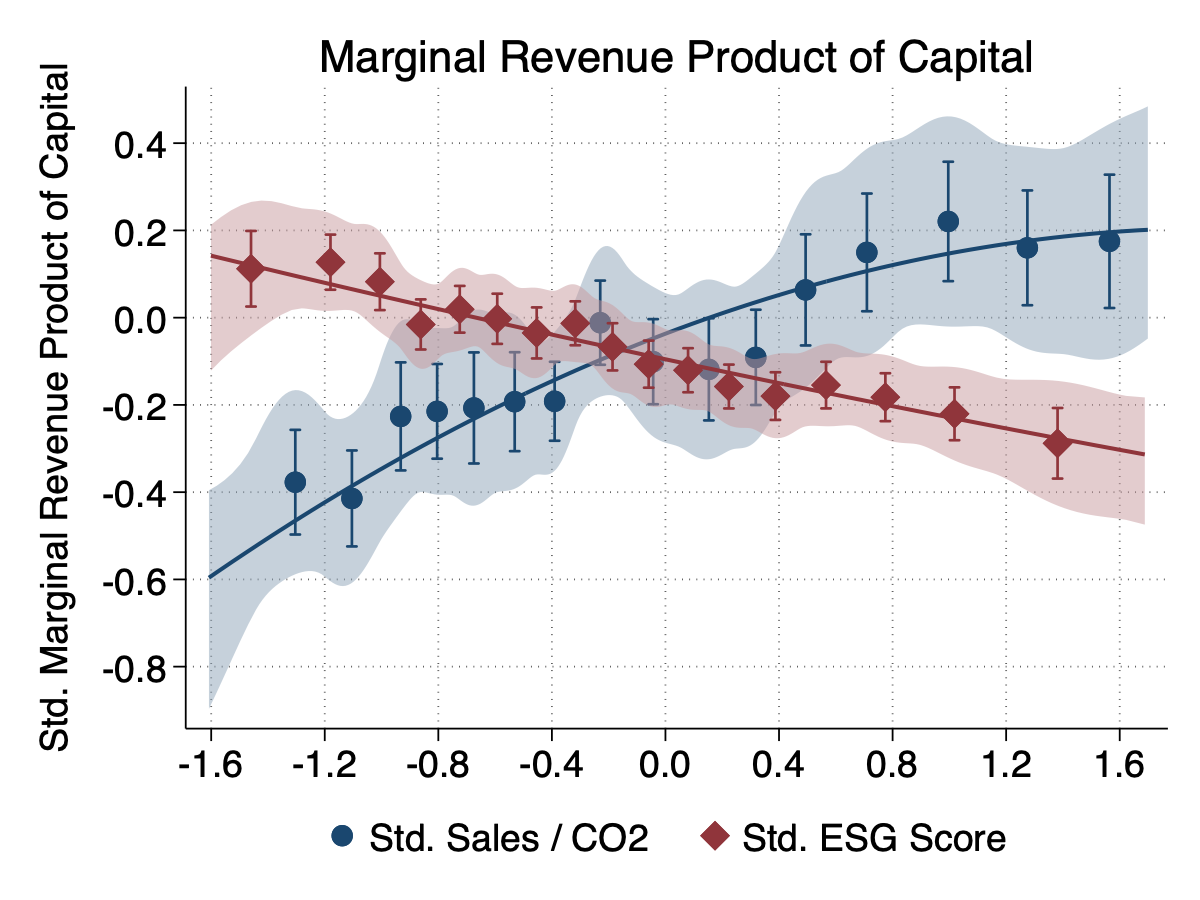

Benchmark-linked capital flows increase firms' CAPM βs, thereby raising managers' perceived cost of equity and reducing investment. Using exogenous variation from Russell and S&P 500 reconstitutions, we show that inclusion in a benchmark stock index increases a stock's CAPM β. Managers interpret the higher β as a higher cost of equity and reduce investment. Consistent with this mechanism, benchmark inclusion also raises the perceived cost of equity among stock analysts and regulators. Industries with larger increases in βs due to benchmarking have accumulated less capital over the past two decades. Benchmark-induced changes in the cross-section of CAPM βs do not cancel out but affect aggregate investment because higher βs fall on many firms with high investment elasticities, while lower βs benefit a few large but inelastic firms.

Seminars:

NYU Stern,

UT Austin,

Boston College Carroll,

Ohio State University Fisher,

Notre Dame Mendoza,

Bocconi University,

University of Maryland Smith,

University of Virginia Darden,

National University of Singapore,

Einaudi Institute,

Copenhagen Business School,

Singapore Management University

Conferences: AFA Annual Meeting 2026, Johns Hopkins Carey Finance Conference, SFS Cavalcade 2025, FIRS 2025, Four Corners/FMRC Conference on Indexing, Investment Company Institute, Northeastern University Finance Conference 2025, UIC Finance Conference 2025c

(* scheduled, c co-author)